Effective Channel Distribution Strategies to Expand Customer Reach

- Channel distribution strategies dictate how brands get products to target buyers.

- Brands should make data-driven decisions on direct versus indirect distribution routes, balancing control versus reach.

- A hybrid distribution model lets brands maximize opportunities through capability aggregation and network effects.

In this Article

Reaching customers has become increasingly complex in today’s multi-channel business landscape. In the past, manufacturers and producers had to place their goods strategically in a storefront or attend countless tradeshows to make sales. Now, companies must develop thoughtful channel distribution strategies to get their products in front of buyers across various physical and digital touchpoints.

Choosing the optimal distribution channels is a major strategic decision that demands careful consideration of several key factors:

- Product type and category norms – Distribution channels vary significantly between product categories and industry verticals. What works for a SaaS (software-as-a-service) company won’t necessarily translate to a practical solution for an industrial equipment manufacturer.

- Pricing and positioning – Premium brands may require more selective distribution through high-end resellers, while budget options can afford mass-market eCommerce platforms. In short, the distribution strategy must align with pricing.

- Brand goals – Companies wanting rapid market share growth may prioritize channels with the highest reach, while niche brands may limit distribution to retain exclusivity.

- Customer buying preferences – B2B (business-to-business) and B2C (business-to-consumer) buyers exhibit very different purchasing behaviors and expect to find products in different places, whether online marketplaces, retail stores, or industrial distributors.

With such complex considerations, choosing the proper sales channels is much more challenging than simply lining products in levels of shelves.

If the challenges strike a familiar chord, this guide is the right place to start as you pursue solutions. It will discuss the basics of distribution channels and show you how to create one. Most importantly, you’ll learn how to execute and manage new strategies with the help of tools like product information management software (PIM) and digital asset management software (DAM).

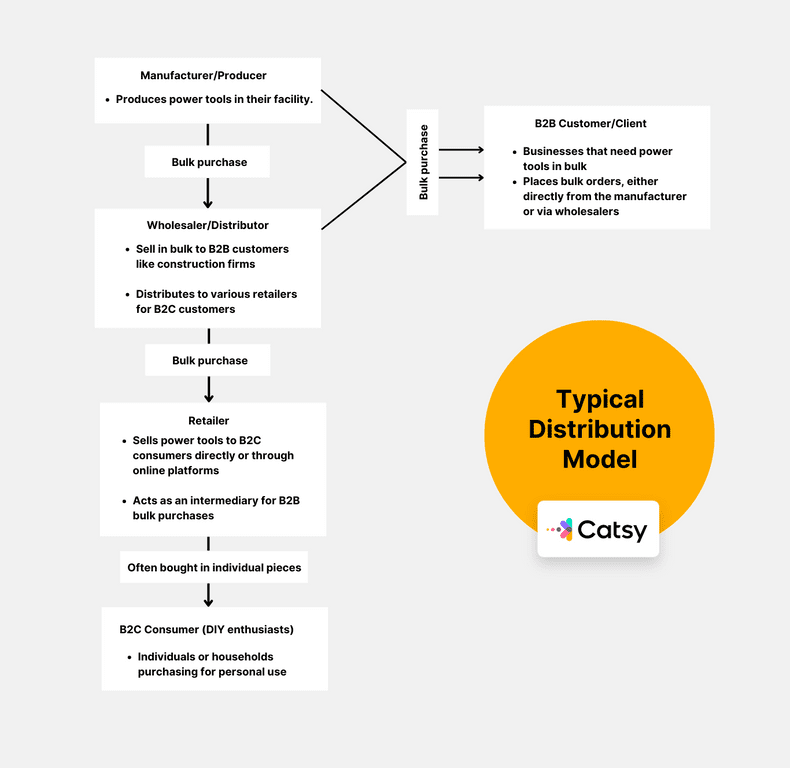

Illustration of a typical distribution channel

As the illustration shows, a typical manufacturer distributes products directly or indirectly to the end user. The direct channel often targets B2B buyers. This section of users is usually companies that require many particular tools. For instance, a construction company may want to purchase 100 drills for its employees.

Although the B2B buyers can get wholesale deals from wholesalers and distributors, they may want to engage with the manufacturer directly for even better pricing.

The manufacturer may also want to get its tools to individual consumers. This section of the audience often buys a single piece for DIY projects or home use. Although the producer may sell directly to the consumers (via eCommerce platforms), the typical distribution channel involves several intermediaries.

It begins with the wholesaler/distributor purchasing large quantities of products from the manufacturer to take advantage of economies of scale. This party then passes the tools on to the retailer. Retailers often have selling points closer to the individual consumer – a retail shop (brick and mortar) or an online storefront.

Given the nature of retail (B2C) buyers, the retailer typically operates in smaller quantities than wholesalers. The retailers could be hardware stores, home improvement centers, or specialized tool shops.

Finally, the end consumer visits the retail store selects the desired power tool, and makes a purchase.

This is a simplified representation, and the actual distribution process may involve more steps or additional intermediaries. It helps to understand that the distribution channel structure can vary based on product type, market strategy, and geographical considerations. As such, a brand should choose a distribution strategy that aligns with the organization’s overall business goals and the product’s characteristics.

Types of Distribution Channels

Although rudimentary, the illustration of a typical distribution channel indicates that brands can choose between two primary distribution channels: direct and indirect. However, secondary channels like dual distribution and reverse distribution merit an independent analysis.

Direct channels

Direct distribution is when the brand decides to cut out all middle parties in favor of direct engagement with the end users of its products. The question is: why go in this direction? Some factors, such as the following, explain this strategy:

- Maximizing profit margins: By eliminating intermediaries, the brand can retain a higher percentage of the retail price as profit. This is particularly beneficial for products with high-profit margins.

- Control over brand image: Direct distribution gives brands more control over how their products are presented and sold. They can create a consistent brand image and control the customer experience without relying on third-party retailers.

- Direct customer relationships: Selling directly to consumers enables brands to establish and maintain direct relationships with their customers. This direct interaction provides valuable insights into customer preferences, behavior, and feedback.

- Flexibility in pricing and promotions: Brands can optimize the pricing strategy based on insights from direct customer relationships. They can also run promotions or discounts without the constraints of retail partners. This allows for more dynamic pricing strategies.

- Better inventory management: Direct distribution allows brands to have better control over inventory levels and reduce the risk of overstock or stockouts. This can lead to improved supply chain efficiency.

- New product launches and test marketing: The immediate access to the end user makes industrial enterprises uniquely positioned to create and fine-tune strategies for launching and testing new products. Brands can gather direct feedback from early adopters and adjust their strategy accordingly.

- Differentiated service levels: Support teams can provide differentiated service and assistance when engaging directly with customers vs. relying on channel partners to service end-user issues.

However, managing the direct-to-consumer (D2C) customer experience can be resource-intensive. You’d need to hire people with specialized skills to handle different aspects of the supply chain. This wouldn’t be part of your in-tray with intermediaries minding the flow of your products from your factory to the end user.

However, for high-priority strategic brands, the benefits of controlling the customer journey often outweigh the extra effort required. This is because, as discussed earlier, vertical integration pays off through better margins, service, insight, and brand ownership.

The common types of direct distribution channels include:

1. Own retail stores

Many industrial brands – particularly huge consumer brands – utilize company-owned retail stores and showrooms to sell directly to end-user customers. For example, Nike and Apple rely heavily on their network of flagship stores to build brand experience while controlling how products are marketed and sold.

2. Online storefronts (ECommerce)

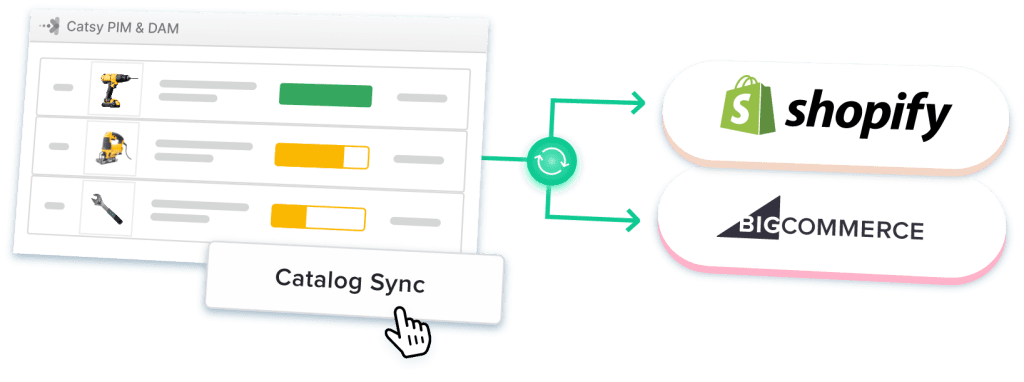

Industrial brands can engage with end-user consumers through owned digital marketplaces. The organization can create and run a storefront on top of platforms like Shopify and BigCommerce or open a merchant store on marketplaces like Amazon.

See Catsy’s Shopify PIM Solution in action today.

ECommerce provides a scalable way – even for smaller producers – to sell directly to customers anywhere while accessing sales data and customer feedback. It also enhances brand control and margins.

But it has challenges, too. These include developing digital retail operations capabilities and driving site traffic to compete with larger online marketplaces. Overall, eCommerce greatly expands direct access to customers without the geographical constraints of physical retail networks.

Direct distribution gives brands more control over the customer experience and better margins. However, this comes at the cost of more significant effort and expenses in areas like retail, digital, and marketing expertise.

Indirect channels

According to Statista, global direct-selling companies generated $173 billion in retail sales in 2022. In contrast, the total global retail sales (offline and online retail) reached an estimated $25.8 trillion that year.

One thing is clear: indirect sales and distribution channels dwarf the alternative, direct channels. This happens even when brands increasingly turn to eCommerce to gain control over their product distribution chain.

What are indirect distribution channels? How do they work? Why do brands prefer this model over direct channels?

Indirect distribution involves using third-party channel partners to sell and deliver products to customers. This leverages external retail, distribution, and selling infrastructures to expand reach efficiently into multiple markets and segments.

Brands may choose the indirect distribution route for the following factors:

- Wider market reach: Indirect distribution allows brands to leverage the existing infrastructure and network of intermediaries to reach a broader market. Retailers often have established customer bases and access to diverse demographic segments.

- Cost efficiency: This is also a direct benefit of distributing through third parties. The costs associated with establishing and maintaining a distribution network may outweigh the benefits for some brands.

- Risk mitigation: Your risk exposure diminishes once the products leave your factory flow and arrive at the distributor’s warehouse. The distributors are in charge of showcasing the products and selling them to end-user consumers, meaning industrial brands are not directly exposed to the risk associated with market fluctuations, economic downturns, or changes in consumer behavior.

- Quick market entry: Indirect distribution can enable brands to quickly enter new markets without significant upfront investments in infrastructure and distribution channels.

- Operational efficiencies: Specialized channel partners maintain key competencies manufacturers often lack, whether logistics, merchandising, or complex B2B services. Relying on those skills drives greater economies of scale.

- Higher sales volumes: Increased distribution footprint coupled with effective external partner promotion to expanded segments tends to drive substantially higher purchase volume through sheer access to larger net-new customer pools.

- Segment intimacy: Wholesalers, distributors, and value-added resellers (VARs) enjoy specialized segment intimacy and relationships that generic vendors cannot match cost-effectively. The local expertise helps drive higher pull-through sales.

Brands amplify reach, scale, bandwidth, and domain expertise through complementary channel partnerships. However, the brands should be ready to coordinate more interdependencies across a multi-party value chain.

While depending on intermediaries for critical operations such as distribution is a significant tradeoff, this is offset (and justified) by the combined incremental sales and capability.

The common indirect channels include:

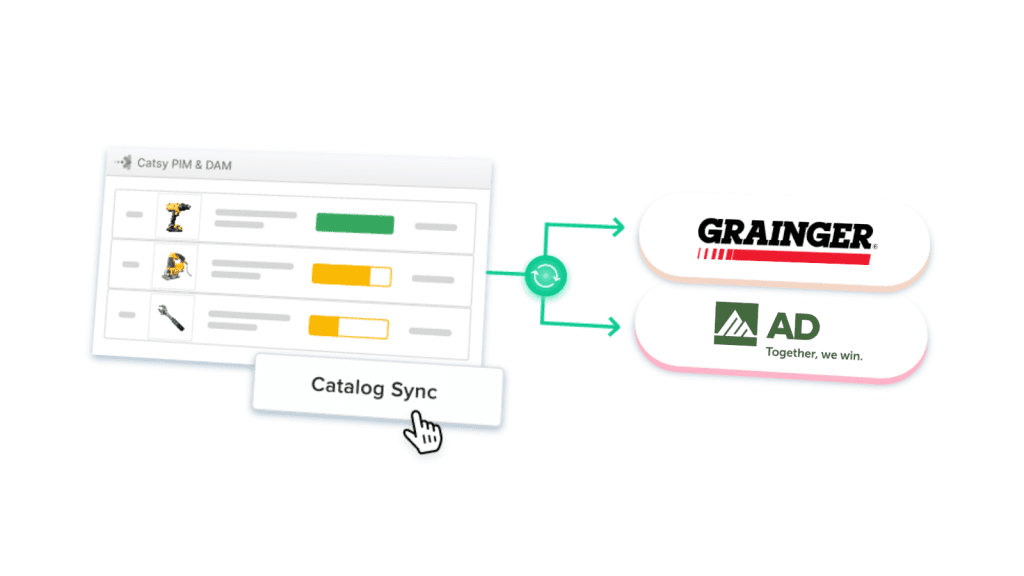

1. Wholesalers and distributors

As in the illustration seen earlier, wholesalers purchase products in bulk quantity from manufacturers and sell smaller quantities to retailers for eventual resale to consumers. This allows retailers to offer a breadth of product selection without tying up working capital in inventory.

Distributors go beyond simple order fulfillment to provide value-added capabilities like technical product support, branding, field sales coverage, channel promotions/incentives, and even light manufacturing or customization services in some industries. Most B2B channels involve specialized third-party distributors tailored to vertical industries.

2. Retailers

Retail stores represent the traditional indirect distribution channel. Whether physical stores, dealers, boutiques, or other independent shopfronts, retailers purchase goods from wholesalers or manufacturers to resell to end-user buyers. Product placements in leading high-traffic retail chains can massively increase brand awareness and sales volume.

3. Value-added resellers (VARs)

VARs provide a hybrid between distribution and consulting or customization. Used often in technology and engineering verticals, VARs add value to base vendor products – hardware or software.

Value-adds may include custom integration work, specialized implementation services, add-ons, custom engineering, or niche capabilities for vertical audiences. The VAR channel increases reach into customized niche markets.

Dual distribution channels

Some enterprise brands leverage a dual distribution strategy rather than taking an either/or approach. This tactic combines direct and indirect channels to maximize reach, capabilities, and customer value.

For example, a power tools manufacturer may sell directly to large industrial customers through a dedicated field sales force. Simultaneously, the company may partner with national distributors and VARs to achieve a broader market presence across general industry trades and contractors.

The direct field sales teams focus on winning large contracts with Fortune 500 mass manufacturers. This allows the company to provide specialized solutions, such as consulting and ongoing service support.

On the other hand, licensed distributor partners tap into their networks of downstream retailers and B2B dealerships to ensure the brand achieves mainstream.

This dual distribution approach allows the Power Tools brand to:

- Directly serve high-value accounts through owned teams while tapping partners to open up broader secondary segments.

- Maintain control over customer experience for strategic accounts while leveraging external infrastructure for scalability.

- Drive branding, service innovation, and pricing power through owned properties while achieving volume economics via wholesale channels.

However, the path to purchase for most B2B buyers may alternate between direct and indirect touchpoints. A buyer may research a product online, purchase through a retail store, and then engage the manufacturer for technical support.

Therefore, there is a need for extensive cross-channel coordination and transparent communication with partners to navigate channel conflicts and pricing disparities successfully. If this strategy succeeds, the payoff can be immense through expanded market participation. Aligned properly, a hybrid direct and indirect distribution combines capability strengths while mitigating individual weaknesses.

Reverse distribution channels

Reverse distribution channels (reverse logistics/flow channels) or reverse commerce (re-commerce) refer to the process where goods move from the end consumer back to the manufacturer or distributor.

Re-commerce is the opposite of the traditional supply chain flow, where goods move from the manufacturer to the end consumer. This enables critical aftermarket value creation.

Some examples of companies utilizing reverse distribution include:

- Returns management: A construction company might return a batch of power drills to the wholesaler due to a manufacturing defect. The wholesaler then returns these drills to the manufacturer for repair or replacement.

- Refurbishment: A retailer might return unsold power saws from the previous season to the manufacturer. The manufacturer can refurbish these saws and sell them as refurbished products.

- Recycling: An industrial user might return used power tools to the distributor once they’ve reached the end of their life cycle. The distributor can then send these tools back to the manufacturer for recycling.

- Disposal: A business might return non-functional power tools to the retailer. The retailer can then send these tools back up the distribution chain for proper disposal.

In all these cases, the reverse distribution channel allows the manufacturer to regain some value from the returned products through repair, recycling, or proper disposal. It also helps build customer loyalty, as businesses appreciate the opportunity to return or recycle products responsibly.

These closed-loop supply chains create environmental and operational efficiencies while letting producers reclaim additional value from sold products after initial use. This cycle reduces waste while tapping into refurbishment/remanufacturing capabilities.

Creating a Channel Distribution Strategy

Developing an optimized distribution strategy is essential for brands aiming to maximize market participation and customer reach. Critical steps include:

Understanding the target market

The first step entails deep market/customer research—qualitative and quantitative—to understand buying behaviors, channel preferences, media habits, technical specifications needs, and overall propensity to purchase based on the outlet—insights from this evaluation help to build a customer persona and map the purchase journey.

For example, a commercial electric vehicle maker would need to analyze if fleet managers purchase through company sales reps, on state contracts via distribution partners, or directly via their own one-off tenders. Each demands tailored channels.

Evaluating different distribution options

Next, brands should objectively audit their direct capabilities versus potential partnership opportunities across areas like breadth of physical or digital presence, service and support capacities, individual channel costs, investment needs and projected reach, and sales potential.

Tradeoffs in areas like margin, control, and reach across D2C websites, wholesale marketplaces, independent dealers, company sales teams, and VARs should become evident. The ideal channel mixes differ by vertical.

Selecting the most effective channels

With market intel plus internal capability context, data-driven decisions can be made on distribution emphasis and investment. Several factors influence the decisions, including customer tier, product line, geography, and use case.

While at it, challenges related to channel conflicts may arise. Brands can address them by segmenting territories or product types to minimize friction.

Implementing the distribution strategy

Finally, targeted buildout and integration work can enhance capabilities around chosen channels. For instance, brands can choose logistics ties to distributors, dealer portal training, or tighter eCommerce personalization.

The goal is an agile, adaptive distribution network that maximizes reach while remaining targeted in customer prioritization for sustainable, profitable growth.

Executing and Managing the Strategy

Successfully deploying and overseeing your distribution strategy is as crucial as its initial design. Once channel priorities have been set, the focus turns to activation and ongoing optimization. Some critical considerations include:

Launch channels, onboard partners

The early emphasis lies in formally enabling chosen outlets. This may include:

- Finalizing terms with distributor partners

- Completing API integrations to support third-party marketplaces

- Ensure seamless viewing of inventory quantities across channels to minimize overselling stockouts.

Provide training and support

All stakeholders in the distribution chain may need to be equipped with extensive knowledge and necessary skills for each channel. This includes product information, pricing strategies, and channel-specific communication nuances.

Additionally, brands should offer ongoing support to channel partners through regular communication, product updates, and performance analysis. This way, they can address emerging concerns and provide resources to maximize success.

Monitoring and adjusting

Brands should highlight what is working well and what combination may need rethinking. To do this, there is a need for continuous tracking of sales velocities, product mix uptake rates, customer metrics, and market response by channel. Agile thinking maintains strategy relevance amid evolving buyer behaviors across channels.

Omnichannel presence

Chances are high that your brand favors a multi-channel distribution strategy. While this approach expands the horizon and exposes your products to a larger audience, it introduces several challenges. They include the need to enforce consistency across channels while enabling localized marketing.

So, you need a coordinated omnichannel presence to amplify branding and reach. Thoughtful orchestration across the distribution network ensures customer experiences stay aligned with positioning as each channel leverages strengths.

However, the question is: how do you ensure seamless data flows and coherence across various channels, especially in an omnichannel environment?

Some essential enablers for omnichannel success include PIM and DAM systems.

A PIM software like Catsy centralizes product data management, ensuring consistency and accuracy in product details, technical specifications, and pricing across all channels. This is essential for delivering a unified brand message and customer experience.

Catsy further provides a digital asset management program under the same roof as the PIM Tool. The goal is to allow users to enjoy more functionality without dealing with integration challenges. The DAM side centralizes the management of digital assets, allowing for efficient distribution and brand control across channels.

PIM DAM Solutions play a crucial role in:

- Creating a seamless omnichannel experience: Consistent product information and branding across all touchpoints foster customer trust and confidence.

- Streamlining channel operations: Efficient data management reduces errors and simplifies channel product updates.

- Improving operational efficiency: Centralized data and assets save time and resources, allowing for a more focused and effective distribution strategy.

Key Takeaways

Selecting the proper distribution channels is akin to choosing the right path through a dynamic marketplace. It’s not a one-size-fits-all endeavor. Also, the effectiveness of a strategy hinges on aligning it with your brand’s unique needs.

The best distribution strategy starts with contextual awareness. Understand the intricacies of your business—its products, target audience, and industry dynamics—before choosing the proper distribution channels. Most crucially, recognize that every brand is unique, and there is no universal solution.

Amazon Vendor Central is a web-based platform that allows vendors to sell their products directly to Amazon. Through Vendor Central, vendors can manage their product inventory, monitor sales performance, and create marketing campaigns. This platform also allows vendors to track and analyze customer data, set prices and promotional pricing, and receive payments from Amazon.

Distributors fulfill critical supply chain roles like aggregating inventory, warehousing products, managing logistics, and selling to downstream resellers. But many also provide value-added services like technical support and training, field sales/reps, channel promotions, and even light manufacturing or customization before goods reach the customers.

Dual distribution blends direct and indirect channels, allowing brands to sell directly to certain select accounts while tapping channel partners to expand market reach. This hybrid approach balances targeted customer control with the capacity/resource advantages of third-party distribution at scale.

The answer depends on your product type, target audience, and resources. Direct channels offer greater control over branding and customer experience but require more internal resources for marketing and fulfillment. On the other hand, indirect channels provide a wider reach and leverage existing distribution networks, but you might have less control over pricing and presentation. A hybrid approach combining direct and indirect channels can often be the most effective solution, allowing you to enjoy the benefits of both worlds.

With Vendor Central, businesses can manage products, pricing, and inventory across multiple Amazon sites in multiple countries. This can be done through one central dashboard, making managing products and orders on multiple sites easier. Vendor Central also allows businesses to take advantage of Amazon’s global reach and increase sales.