Brands: Optimize Distributor Partnerships with PIM and DAM

- Distributor partnerships allow manufacturers to scale sales and market reach quickly.

- Inaccurate product data undermines distributor efficiency, customer experience, brand reputation, and inventory management.

- A unified PIM and DAM platform powers accurate, enriched product data sharing between manufacturers and distributors.

In this Article

Companies regularly adjust their strategies and operations to respond to market environment changes and negotiate better terms with their partners. For example, a manufacturer facing stiff competition may partner with distributors in various jurisdictions to reach more customers with its products.

Interestingly, most companies are likely to utilize distributor partnerships to drive sales. Data shows that this strategy works most of the time. For example, an analysis by Concur found that 77% of companies participating in distributor partnerships have seen direct or indirect profit growth.

However, McKinsey and Company established that most distributor partnerships fail to deliver optimum results because manufacturers do not provide distributors with appropriate support. For example, some companies have poor data management practices, affecting product data accuracy. This creates friction because distributors, who interface directly with customers, have difficulty meeting buyers’ expectations.

Is there a way around this particular challenge? The short answer is yes. Read on for a detailed explanation.

Understanding Distributor Partnerships

What is a distributor partnership?

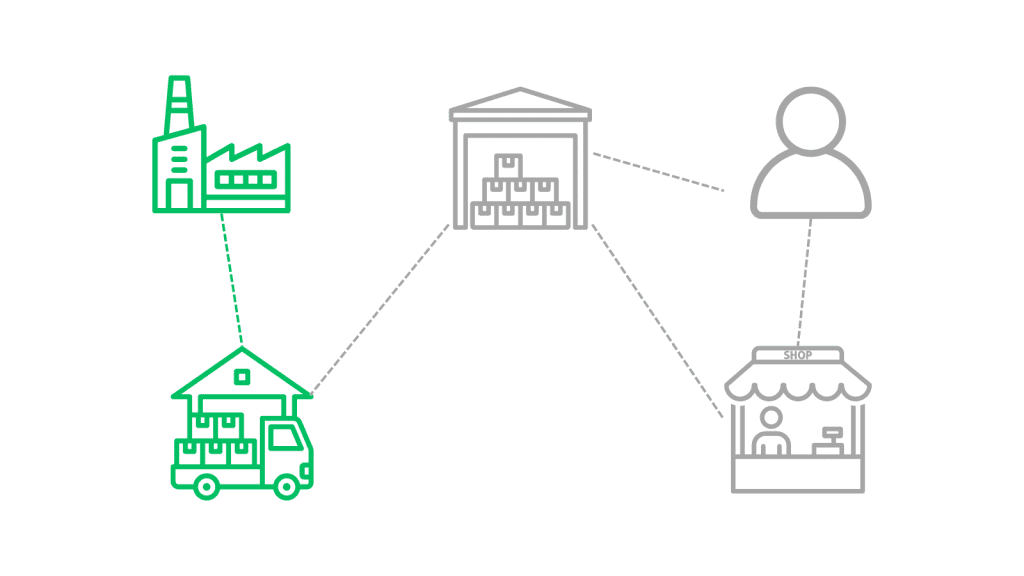

This is a business arrangement in which a manufacturer grants a third party the right to sell its products in a specific market. The third-party is often an independent distributor or reseller who markets and sells a manufacturer’s products as if they were theirs.

The primary role of the distributor is to act as an intermediary between the manufacturer and final customers. They purchase products from the manufacturer, stock inventory in their warehouses, and then resell those products to retailers, other businesses, or directly to consumers.

An illustration of how distributor partnerships work

Let’s say DeWalt, a major manufacturer of professional power tools, wants to expand its sales reach into new international markets. The company partners with established distributors in those regions rather than setting up its local sales teams and distribution centers globally.

In Europe, DeWalt signs an agreement with Ferguson, a leading distributor of industrial and construction products. As part of the partnership, Ferguson becomes an authorized DeWalt distributor for several European countries.

Ferguson orders DeWalt’s products in bulk and ships them to its warehouses throughout Europe. DeWalt also provides Ferguson with product information, marketing materials, training for its sales reps, and guidelines on pricing and promotions.

Ferguson’s sales teams then market and sell DeWalt’s products to construction companies, factories, hardware stores, and other businesses within their assigned territories. They leverage their local market knowledge to generate demand.

When orders come in, Ferguson handles all the distribution logistics—packing, shipping, processing customer payments, and managing inventory levels across its network of warehouses.

For this service, Ferguson keeps a percentage of the product revenue as its distributor margin. DeWalt benefits by quickly gaining vast sales coverage without the significant investment to set up its distribution in all those European countries.

The partnership allows DeWalt to focus on manufacturing great new products while Ferguson utilizes its distribution expertise and local presence to promote and deliver those products successfully.

This example provides several hints regarding the strategic mutual benefits of the business arrangement.

The mutual benefits of distribution partnerships

1. Expanding market reach and customer base

All companies want to expand their market reach as far as possible. However, they often have limited resources and expertise to penetrate diverse markets effectively, which can impact their ability to earn more money over a period of time. We explained earlier that most companies opt for partnerships with dominant players in critical supply chain stages to overcome these limitations.

For example, the previous illustration shows DeWalt partnering with Ferguson as a distributor in multiple European countries. This arrangement allows DeWalt to quickly gain sales coverage in these markets.

The alternative would have been to build their own local sales teams, distribution centers, and logistics capabilities country-by-country. However, DeWalt leveraged Ferguson’s existing European distribution network and workforce. This allowed DeWalt’s products to reach an exponentially larger base of potential customers, which Ferguson already services within those territories.

The distributor, too, obtains some benefits. For example, Ferguson’s alliance with DeWalt allows the distributor to enhance their product portfolio with high-quality industrial equipment. This can attract new customers searching for specific brands or types of power tools.

Also, DeWalt’s brand reputation adds credibility to Ferguson’s offerings, potentially increasing their overall sales and market share within the industrial supplies sector.

Improving industry logistics and supply chain efficiency

Distributor partnerships allow manufacturers to enhance logistics and supply chain efficiency. They leverage distributors’ established distribution channels and infrastructure to deliver products across vast geographical areas.

In the illustration, DeWalt avoids the massive costs and complexity of setting up its distribution centers, warehousing, local delivery fleets, and last-mile logistics in each European country where it wants to sell. Instead, the manufacturer relies on Ferguson’s existing distribution capabilities in those markets.

This allowed for a much more efficient supply chain. DeWalt manufactures and ships bulk orders to just a few of Ferguson’s distribution hubs rather than having to manage point-to-point shipping to endless customer locations. Ferguson then takes care of the warehousing, order fulfillment, local transportation, and last-mile delivery to end customers.

On the other hand, Ferguson can optimize its existing warehouse space and utilize its fulfillment capabilities more efficiently.

3. Localization and customization of products

Partnering with established local distributors allows manufacturers to more easily localize and customize their products for specific markets and customer needs.

Distributors often have deep knowledge and understanding of their territories’ regulations, usage conditions, buyer preferences, and cultural nuances. This valuable local expertise helps manufacturers adapt products appropriately.

For example, DeWalt may need to tweak certain features, accessories, or packaging to meet differing electrical standards, construction site requirements, or language needs across the various European markets Ferguson serves.

Without the distributor’s on-the-ground insights, it becomes challenging for a manufacturer to localize offerings effectively. This localized knowledge can significantly enhance the appeal of the manufacturer’s products, making them more relevant and attractive to the target audience, ultimately leading to increased sales and market penetration.

4. Sharing resources and mitigating risks

Distributor partnerships allow both parties to utilize one another’s resources and moderate certain business risks that each would otherwise have to shoulder entirely on their own.

The manufacturer can leverage the distributor’s existing sales teams, marketing capabilities, warehousing space, logistics operations, and market knowledge in that local territory. This allows them to scale sales and distribution without investing heavily in building redundant capabilities in each new market.

In the DeWalt example, rather than hiring local sales reps, running marketing campaigns, leasing warehouse space, and deploying trucks for distribution in each European country, they can rely on Ferguson’s already established resources in those areas. This is a much more cost-effective and lower-risk method of market entry.

The distributor also benefits by gaining access to the manufacturer’s products, brand reputation, marketing resources, and technical expertise. Offering DeWalt’s leading products allows Ferguson to strengthen its overall product portfolio and value to customers within its distribution footprint.

Furthermore, the partnership lessens risks for both parties. DeWalt has reduced risks in foreign customer credit, localized inventory management, regulatory compliance, and other international operations. Ferguson takes on those localized risks within its territory in exchange for sharing revenue in product sales.

On Ferguson’s side, adding DeWalt’s well-known brand lowers their product-line risk compared to taking a chance on unknown, unproven suppliers. There are established quality standards and demand around DeWalt’s products.

Why Product Data Accuracy Matters in Distributor Partnerships

What is product data?

Product data is the details that describe and define a product’s attributes, features, specifications, digital assets, and metadata. These details are often found in inventory management systems that help businesses succeed by providing accurate product data. However, they are typically barebones and may not make sense to outsiders.

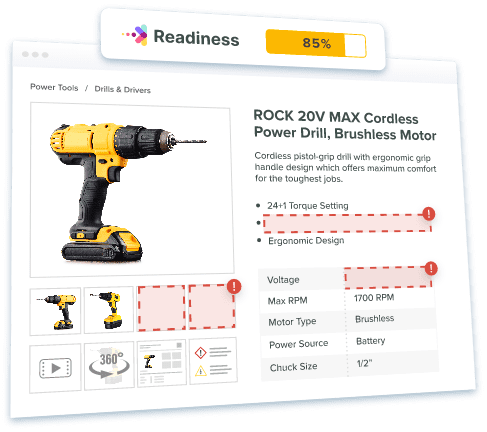

One of the best data management practices is making information legible by adding flesh to the skeleton. This process, called “product information enriching, ” uses specialized product information management (PIM) software.

Similarly, digital assets may be scattered across storage drives (local and in the cloud). These assets are expensive to produce and invaluable to the brand. You can store and enrich them safely using specialized digital asset management software.

The accuracy and completeness of product data are not a huge deal when focusing on simple products like apparel. It gets complicated when focusing on industrial products, as the data encompasses extensive details. This includes technical specs, product dimensions/weights, compatible parts/accessories, safety certifications, equipment ratings, instruction manuals, 3D models, photography, videos, and more.

Accurate, complete, and up-to-date product data is critical. Distributors, salespeople, customers, and other distribution partners rely on this information to properly understand, market, sell, and ultimately utilize industrial products as intended. Even minor inaccuracies can have significant implications.

What is the impact of inaccurate product data within distributor partnerships?

1. Inefficient order fulfillment

When manufacturers provide new distributors with inaccurate or incomplete product data, it directly impairs their ability to fulfill customer orders efficiently. Product data serves as the system of record that distributors rely on to correctly identify, spec, kit, price, and process orders for the manufacturer’s products.

For example, if technical specifications are wrong or missing, distributors are more likely to misinterpret or enter incorrect details into their inventory management systems. This could result in the wrong products being pulled from inventory to fulfill orders.

Inaccurate product data can also lead to inefficient warehouse picking and packing processes. For example, if product codes don’t properly synchronize between the manufacturer and distributor’s systems, order throughput decreases considerably.

Additionally, lousy pricing data frequently causes orders to get held up due to manual intervention to resolve discrepancies between what was quoted and ordered versus actual costs in the system.

Product data inaccuracies introduce potential errors into a distributor’s order management and fulfillment workflows. This reduces efficiency with delays, extra overhead costs, unsatisfied customers, and strained manufacturer partnerships.

2. Negative customer experience

Inaccurate product data also leads to negative customer experiences and higher return rates. When orders from manufacturers to their distributors contain errors, the end customer suffers the consequences.

If, for example, a customer orders a power tool based on product details on the distributor’s website, but what actually gets delivered is different due to incorrect source data from the manufacturer, the customer will be frustrated and disappointed right out of the gate.

In situations like these, customers face a return and re-order process. During this period, they will endure shipping delays or have to make do with a product that doesn’t truly satisfy their needs—a lose-lose either way. This breeds negative brand perception, strained relationships with the distributor, and an overall frustrating customer experience.

High return rates from product data errors also create significant reverse logistical costs and overhead for the distributor and manufacturer. This costly inefficiency would be entirely avoidable if all parties had access to pristine, verified product data to work from initially.

3. Damaged brand reputation

When distributors repeatedly provide inaccurate product information or ship incorrect orders to customers due to faulty data received from manufacturers, it can significantly damage the brand reputations of both parties over time.

For the manufacturer’s brand, having a distributor represent their products inaccurately to the market, whether through incorrect marketing materials, technical specs, or pricing, erodes trust and perceived quality. Customers may start to question if the products deliver what is promised, which can push them to seek alternatives.

Additionally, customers tend to directly associate fulfillment issues like missing components, delays, or products that don’t match the original descriptions with the manufacturer’s brand itself. The customer often doesn’t differentiate between the distributor and the actual brand maker. So, when the experience is negative, they will perceive the name on the product’s packaging as unreliable.

The result is that manufacturers are perceived as untrustworthy, sloppy, or indifferent about their products and customers. This is the worst outcome for brands that have spent years building equity and positive associations. This can be undone if their products consistently under-deliver on expectations set by their distributor partners due to insufficient data, potentially leading to a breakdown in the contract cycle.

The distributor’s brand reputation suffers as well. If they consistently provide customers with wrong information, ship incorrect orders, or cannot correctly represent the products they sell, they’ll quickly gain a reputation for being unreliable and disorganized. This damages customer loyalty and relationships.

4. Sales and inventory management issues

Inaccurate product data flowing from manufacturers to distributors also creates significant downstream issues, such as sales forecasting, inventory levels, and avoiding stockouts or overstocking.

Distributors rely heavily on manufacturer-provided product information to decide what products to purchase, in what quantities, and how to prioritize merchandising/promotions. When that product data is incomplete or erroneous, it completely skews the distributor’s sales and inventory management capabilities.

Conversely, vague or misleading product details may cause a distributor to overestimate customer interest. Subsequently, the distributor may overstock certain items that then struggle to sell directly as expected, increasing the distributor’s carrying costs and inventory risks.

Additionally, inaccurate compatibility data around product parts, accessories, etc., can cause problems for a distributor’s capacity to correctly bundle or pack the right product mixes to satisfy customer demands. They may stock the wrong mix, leading to inefficient inventory utilization.

Distributors must operate without visibility if they can’t trust the master product data. This severely diminishes their capabilities in demand forecasting, inventory optimization, marketing and sales execution, and profitability. What started as a strategy to grow profits and forge trust may result in prolonged legal battles and subsequent business collapse.

How PIM and DAM Foster Accuracy and Growth

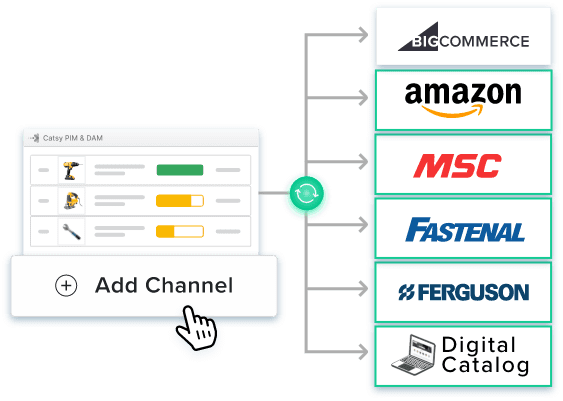

PIM and DAM tools can salvage distributor partnerships if inaccurate product data is the source of contention. These platforms allow manufacturers to centralize, enrich, and precisely control the master product data and digital assets, ensuring they provide complete and up-to-date retail product line content to distributor partners.

One of a key features of product content management software is its ability to transform skeleton details obtained from ERPs and other backend systems into enriched information that is legible to customers, fostering a stronger connection with them. It allows manufacturers to add descriptions, specifications, metadata, and tags, making product data more comprehensive and appealing. PIM also ensures that this enriched data is consistent across all distribution channels, reducing the risk of discrepancies and confusion that can damage distributor relationships.

Distributors need access to relevant digital assets in addition to core product details. A DAM system helps manufacturers store, organize, and manage all their digital assets in a centralized and secure location. It also ensures that digital assets are appropriately formatted, optimized, and enriched with tags and alt-text.

Most robust DAM solutions, such as Catsy, provide a brand portal for efficient sharing of digital assets. The brand portal allows partners to self-serve assets, ensuring they get the needed assets whenever needed. The feature also has robust access management capabilities for enhanced security, so manufacturers can control who can view, download, and edit their assets.

This way, manufacturers can provide their distributor partners with high-quality images, videos, documents, and other media that complement and enhance the product information.

However, these tools are optimized when tightly integrated, creating a unified product data management platfor

A unified PIM and DAM platform is the best backend for a successful product data management strategy.

When a PIM and DAM’s functionalities combine, they establish a unified platform where manufacturers can enrich and organize all product data elements in one place. They can create and enrich technical specifications, product descriptions, pricing, and inventory data while uploading and enriching assets like images, videos, and documents.

Instead of siloing that information across multiple systems, teams, and locations, the unified platform becomes the consolidated, authoritative source of truth that ensures data accuracy and consistency across all distribution channels.

From the PIM side, manufacturers can manage product data cleanliness through features like:

- Data validation tools to identify incomplete and inaccurate data

- Workflow approvals before publishing data changes

- Centralized management of product taxonomy and categorization

The DAM component allows comprehensive control over the related digital assets. It also adds functionalities like:

- Advanced metadata tagging for asset organization and findability

- Automated transforming of assets into distributor-required formats

- Asset usage permissions and version control

A unified PIM and DAM platform like Catsy enables users to do more in less time, something that separately sold solutions cannot achieve. The robust functionalities save time, reduce errors, and improve the consistency and quality of the information shared with partners.

In other words, the integrated PIM and DAM environment allows manufacturers to ensure distributors always have access to the latest, most accurate, and up-to-date product content. This prevents ordering issues, inventory mishaps, customer incidents, and operational inefficiencies that commonly disrupt partnerships when product data is inaccurate or decentralized.

Final Thoughts

Product data is a critical resource that cements distributor partnerships. It enables manufacturers to communicate their value proposition, differentiate their products, and comply with industry standards and regulations. Distributors rely on product data to market and sell the products they carry, provide customer service, and manage inventory and orders. Therefore, ensuring that product data is accurate, complete, consistent, and up-to-date is essential for building trust and loyalty between manufacturers and distributors.

While PIM and DAM solutions can provide significant value independently, users truly maximize their ability to deliver the product data accuracy and enablement distributors need when these systems are unified into a single, integrated platform.

A tightly integrated PIM and DAM environment establishes a proper “system of record” for all master product data elements. This creates an authoritative, centralized source that manufacturers can rely on for managing, enriching, and validating product data quality.

From this unified PIM and DAM backbone, manufacturers gain the capability to syndicate definitive product data and assets out to distributor partners through automated feeds, portals, and publishing channels. This consistent flow of pristine product information positions distributors for success in properly representing products, staffing knowledgeable sales teams, optimizing inventory levels, and delighting customers through positive brand experiences.

They include technical specifications, product descriptions, pricing, categorization data, product codes, product relationships (kits, accessories, etc.), regulatory/compliance data, product marketing content, rich media assets like images, videos, and 3D models, product documentation like manuals, and digital product renditions for e-commerce. Having a single source of truth for all this data prevents issues when distributing it to partners.

Inaccurate or incomplete product data flowing to distributors frequently leads to negative customer experiences in a few key ways: orders getting fulfilled with the wrong products, delays on orders, components missing from product bundles, sales staff’s inability to correctly market features, and customer returns and refunds due to products not matching expectations set by the product data. Customers get frustrated when their orders don’t match what was represented.

Industrial products are inherently complex, and the number of technical attributes that need to be accurately detailed is exponentially greater. There are complex specifications, product configurations, compatibility data, industrial certifications, product documentation, and more to account for. Any misstep in data accuracy could violate safety regulations or cause products to be unusable for their intended purposes. The room for error is far less.

Complete and accurate product data is essential for distributors to forecast demand correctly and set stocking levels to avoid stockouts or overstocks. They rely on data like product descriptions, pricing, product bundling details, and other marketing data to gauge customer demand. If crucial data elements are missing or wrong, it can completely throw off their sales projections and inventory planning. This leads to carrying costs or lost sales from not having the right products available.

A PIM centralizes and validates the core product details like technical specifications, descriptions, categories, etc. DAM software does the same for product-related media like photos, videos, documents, etc. When integrated, users can quickly map assets to corresponding product details in PIM to create enriched product experiences. This high-quality product data can be distributed to sales and marketing channels like distributor portals. The tight integration ensures consistent, high-quality product data and assets.